Startup funding options set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

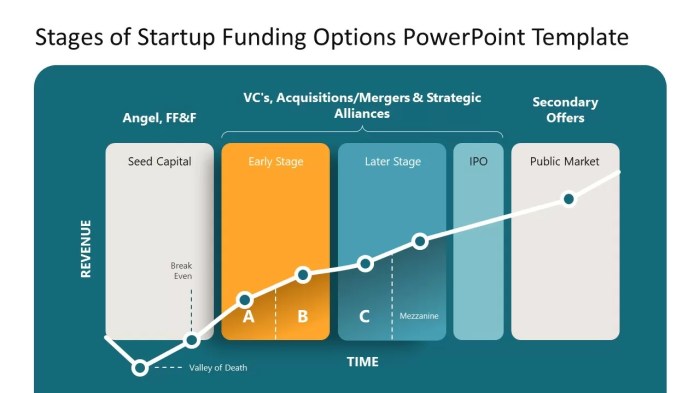

In the world of entrepreneurship, securing funding is crucial for turning innovative ideas into successful businesses. Let’s dive deep into the various avenues available for funding startup ventures.

Traditional Funding Options: Startup Funding Options

When it comes to funding your startup, there are several traditional options you can consider. These include bank loans, personal savings, and venture capital. Each of these options has its own set of pros and cons, so it’s important to understand them before making a decision.

Bank Loans

- Bank loans are a common way for startups to secure funding.

- Pros include relatively low interest rates compared to other options.

- Cons may include strict eligibility criteria and the need for collateral.

Personal Savings

- Using personal savings is a straightforward way to fund your startup.

- Pros include no debt or equity stake given up.

- Cons may include limited funds available and personal financial risk.

Venture Capital, Startup funding options

- Venture capital involves investors providing funds in exchange for equity in the startup.

- Pros include access to large amounts of capital and expertise from investors.

- Cons may include loss of control and potential conflicts with investors.

Alternative Funding Routes

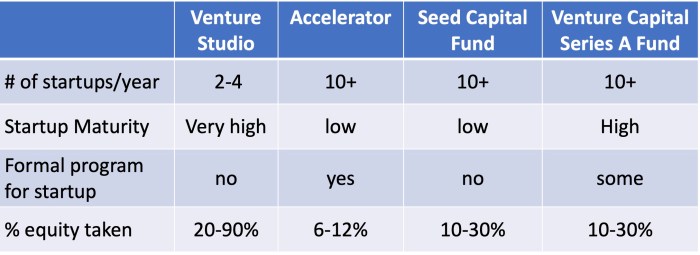

In addition to traditional funding options, startups can explore alternative routes to secure the capital they need to grow and succeed. Alternative funding options like crowdfunding, angel investors, and accelerators have become popular choices for many entrepreneurs looking for capital infusion.

Crowdfunding is a way for startups to raise funds by collecting small amounts of money from a large number of people, typically online. This method allows startups to reach a wider audience and validate their business idea while securing funding. However, it can be challenging to stand out among the numerous crowdfunding campaigns and attract investors.

Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt. They often offer valuable expertise and connections in addition to funding. While angel investors can be a great source of capital, startups may have to give up a portion of their ownership and decision-making power.

Accelerators are organizations that offer funding, mentorship, and resources to startups in exchange for equity. Startups accepted into accelerator programs receive support to accelerate their growth and increase their chances of success. However, accelerators can be highly competitive, and startups may face pressure to meet milestones and deliver results quickly.

Successful Examples

- Uber: Uber initially secured funding through angel investors and later participated in accelerator programs to fuel its rapid expansion.

- Oculus VR: Oculus VR ran a successful crowdfunding campaign on Kickstarter to fund the development of its virtual reality headset, which later attracted the attention of major investors like Andreessen Horowitz.

- Pebble: Pebble raised over $10 million through a crowdfunding campaign on Kickstarter to launch its smartwatch, becoming one of the most funded projects on the platform at the time.

Bootstrapping

Bootstrapping is the process of building a business from the ground up with little to no external funding or investment. This means that the entrepreneur relies on their own resources, such as personal savings, revenue generated by the business, or loans from friends and family, to fund the startup.

Advantages of Bootstrapping

- Independence and Control: Bootstrapping allows the entrepreneur to maintain full control over the business decisions without having to answer to external investors.

- Cost-Efficiency: By relying on personal resources, the startup can minimize costs and allocate funds more efficiently.

- Faster Decision-Making: Without the need to consult with investors, decisions can be made quickly, enabling the business to adapt and pivot more effectively.

- Stronger Financial Discipline: Bootstrapping encourages financial discipline and resourcefulness, as the entrepreneur must make the most out of limited resources.

Disadvantages of Bootstrapping

- Limited Growth Potential: Without external funding, the business may struggle to scale quickly or capitalize on growth opportunities.

- Financial Risk: The entrepreneur bears all the financial risk personally, which can be stressful and risky, especially if the business fails.

- Resource Constraints: Bootstrapping can limit access to resources, talent, and expertise that external investors could provide.

- Slower Growth: Due to limited resources, bootstrapped startups may experience slower growth compared to those with external funding.

Tips for Bootstrapping Entrepreneurs

- Focus on Generating Revenue Early: Prioritize revenue generation to sustain the business and reinvest profits for growth.

- Minimize Costs: Keep expenses low and look for cost-effective solutions to stretch your resources further.

- Build a Strong Network: Leverage relationships with mentors, advisors, and other entrepreneurs for support, guidance, and potential partnerships.

- Stay Agile and Adaptable: Be prepared to pivot and adapt to market changes quickly to stay competitive and seize opportunities.

Pitching to Investors

When it comes to pitching to investors for startup funding, there are key elements that can make or break your pitch. From highlighting your unique value proposition to demonstrating market potential, a successful pitch requires careful planning and execution.

Key Elements of a Successful Investor Pitch

- Clear and Concise Business Plan: Investors want to see a solid business plan that Artikels your product, target market, revenue model, and growth strategy.

- Compelling Value Proposition: Clearly articulate what sets your startup apart from the competition and why customers will choose your product or service.

- Demonstrate Traction: Show evidence of market validation, such as user growth, partnerships, or revenue streams, to prove your startup’s potential for success.

- Financial Projections: Provide realistic and well-researched financial projections that demonstrate a clear path to profitability and return on investment for investors.

Strategies for Effectively Pitching to Different Types of Investors

- Angel Investors: Focus on the passion and vision behind your startup, as angel investors are often more interested in the founding team and the problem you are solving.

- Venture Capitalists: Emphasize the scalability and market potential of your startup, as VCs are looking for high-growth opportunities that can deliver significant returns.

- Crowdfunding Platforms: Leverage the power of storytelling and community engagement to attract individual investors on crowdfunding platforms like Kickstarter or Indiegogo.

Real-World Examples of Startups that Secured Funding through Successful Pitches

- Uber: Uber’s pitch to investors focused on the massive market opportunity for on-demand transportation services and the company’s innovative technology platform.

- Airbnb: Airbnb’s pitch highlighted the sharing economy trend and the potential for disrupting the hospitality industry with a peer-to-peer accommodation marketplace.

- Slack: Slack’s pitch emphasized the need for better communication tools in the workplace and the company’s rapid user adoption and growth metrics.