Renter’s insurance options sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

When it comes to renting a place, having the right insurance coverage can make all the difference. Renter’s insurance not only protects your belongings but also provides liability coverage, ensuring you’re covered in various situations. Let’s dive into the world of renter’s insurance options and explore the different policies available to tenants.

Overview of Renter’s Insurance: Renter’s Insurance Options

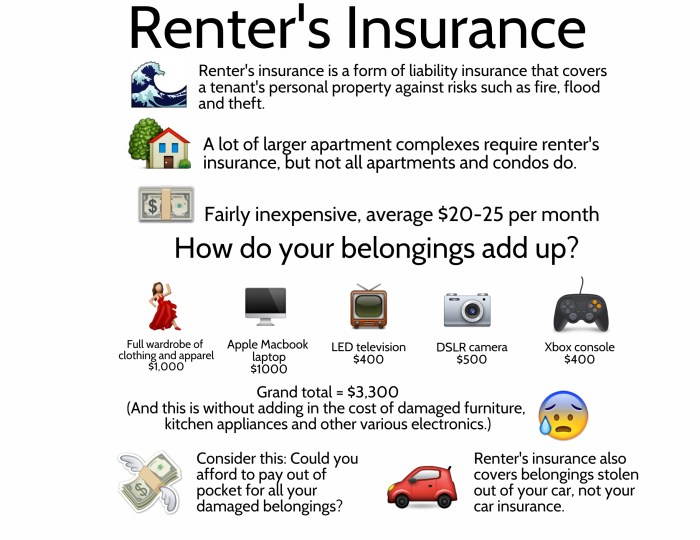

Renter’s insurance is a crucial financial safety net for tenants who rent a property. It provides protection for personal belongings, liability coverage, and additional living expenses in case of unexpected events.

Key Components Covered by Renter’s Insurance

- Personal Property Coverage: This includes protection for personal belongings such as furniture, electronics, clothing, and more in case of damage or theft.

- Liability Coverage: Renter’s insurance also offers liability protection, covering legal expenses if someone is injured in your rental property.

- Additional Living Expenses: In the event that your rental becomes uninhabitable due to a covered peril, renter’s insurance can help cover additional living expenses like hotel bills or temporary rentals.

Benefits of Having Renter’s Insurance

-

Renter’s insurance provides peace of mind knowing that your personal property is protected in case of emergencies or unforeseen events.

-

It offers liability coverage, safeguarding you from potential legal expenses if someone is injured on your rental property.

-

Having renter’s insurance can also help you save money in the long run by covering costly expenses that may arise from damages or theft.

Types of Renter’s Insurance Policies

When it comes to renter’s insurance, there are different policies available to cater to the varying needs of tenants. Let’s explore the types of renter’s insurance options in the market and compare basic coverage with comprehensive plans.

Basic Renter’s Insurance vs. Comprehensive Coverage

Basic renter’s insurance typically covers personal property, liability, and additional living expenses in case of a covered event. It offers essential protection for renters without extensive coverage needs. On the other hand, comprehensive coverage provides broader protection, including additional perils, higher coverage limits, and optional endorsements for specific items or risks.

Coverage Options

- Personal Property: This coverage protects your belongings, such as furniture, electronics, and clothing, in case of theft, fire, or other covered events.

- Liability: Liability coverage helps protect you financially if someone is injured in your rental unit and you are found responsible. It can also cover property damage caused by you or a family member.

- Additional Living Expenses: In the event your rental becomes uninhabitable due to a covered loss, this coverage helps pay for temporary living arrangements, such as hotel stays or rental costs.

Factors to Consider When Choosing Renter’s Insurance

When selecting a renter’s insurance policy, there are several important factors to take into consideration to ensure you get the coverage that best meets your needs.

Location

The location of your rental property plays a significant role in determining the cost and coverage options of your renter’s insurance policy. Factors such as crime rate, weather risks, and proximity to fire stations can impact your premium rates and coverage limits.

Coverage Limits

It is essential to assess your personal property value and determine the appropriate coverage limits for your belongings. Make sure your policy covers the replacement cost of your items, not just their current value, to avoid being underinsured in case of a loss.

Deductibles

Consider the deductible amount you are comfortable paying out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premium costs, but make sure you can afford to cover the deductible in case of a claim.

Additional Endorsements

Depending on your needs, you may want to add endorsements to your policy for extra coverage. This could include coverage for high-value items like jewelry or electronics, as well as liability protection in case someone is injured on your rental property.

Understanding Policy Exclusions and Limitations

Take the time to read through your policy documents carefully to understand what is covered and what is not. Pay attention to exclusions and limitations, such as coverage for floods or earthquakes, and consider adding additional coverage if needed.

Cost of Renter’s Insurance

When it comes to renter’s insurance, the cost is a crucial factor that renters need to consider. The cost of premiums can vary based on several factors that insurance companies take into account.

Factors Influencing the Cost of Renter’s Insurance Premiums, Renter’s insurance options

- The coverage amount: The more coverage you want, the higher your premium will be.

- Location: If you live in an area prone to natural disasters or high crime rates, your premium may be higher.

- Deductible: A higher deductible typically means lower premiums, but you’ll pay more out of pocket in case of a claim.

- Personal factors: Your credit score, claims history, and age can also impact the cost of your renter’s insurance.

Tips to Lower Insurance Costs

- Bundle your policies: Consider getting your renter’s insurance from the same provider as your auto insurance to save money.

- Improve security: Installing smoke detectors, security systems, or deadbolts can reduce your premiums.

- Shop around: Compare quotes from different insurance providers to find the best deal.

- Ask about discounts: Inquire about discounts for things like being a non-smoker or having good credit.

Comparing Quotes from Different Providers

- Quotes can vary significantly between insurance companies, so it’s essential to compare them to ensure you’re getting the best value for your money.

- Look beyond the price: Consider the coverage limits, deductibles, and customer reviews when comparing quotes.

- Don’t settle for the first quote you receive; take the time to explore different options and find the right fit for your budget and needs.