Diving into renter’s insurance options, this introduction sets the stage for a cool and informative discussion that breaks down the different coverage choices available to tenants. From basic coverage to additional options, get ready to learn all about protecting your rental space in style.

Whether you’re a first-time renter or a seasoned tenant, understanding the ins and outs of renter’s insurance is crucial for safeguarding your belongings and peace of mind. Let’s uncover the key aspects of this important topic together.

Renter’s Insurance Options

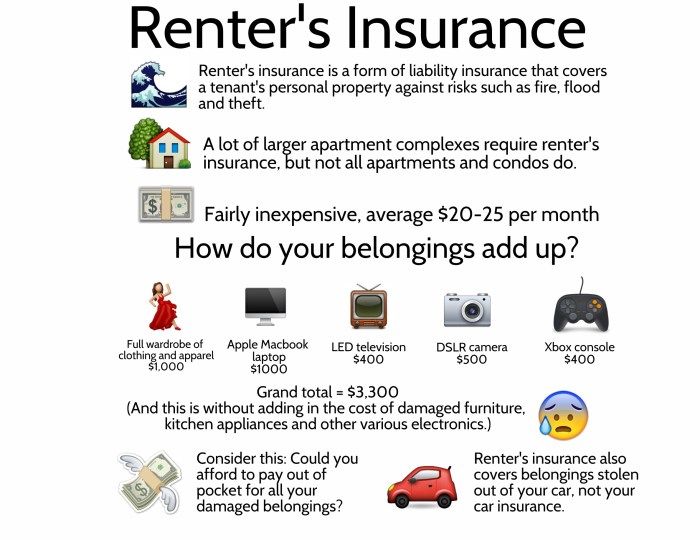

Renter’s insurance is a type of policy designed to protect tenants in case of unexpected events like theft, fire, or water damage. It provides coverage for personal belongings and liability protection.

Types of Coverage Options

When it comes to renter’s insurance, there are different types of coverage options available to choose from:

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing, in case of covered perils.

- Liability Coverage: This helps cover legal expenses and medical bills if someone is injured in your rental property.

- Additional Living Expenses: In case your rental becomes uninhabitable due to a covered event, this coverage helps pay for temporary living arrangements.

Benefits of Renter’s Insurance

Renter’s insurance offers several benefits compared to not having any coverage:

- Protection of Personal Belongings: In case of theft, fire, or other disasters, your personal belongings are covered.

- Liability Protection: If someone is injured in your rental, liability coverage helps cover legal expenses and medical bills.

- Peace of Mind: With renter’s insurance, you can have peace of mind knowing that you are financially protected in case of unforeseen events.

Basic Coverage: Renter’s Insurance Options

When it comes to renter’s insurance, basic coverage typically includes protection for your personal belongings, liability coverage, and additional living expenses in case your rental becomes uninhabitable due to a covered event.

Personal Belongings

Basic coverage for personal belongings typically includes protection against damage or theft for items such as clothing, furniture, electronics, and other personal possessions. This coverage can be a lifesaver in scenarios like a break-in, fire, or water damage where your belongings are damaged or stolen.

Liability Coverage

Liability coverage is another important component of basic renter’s insurance. This coverage can help protect you financially if someone is injured in your rental unit or if you accidentally damage someone else’s property. For example, if a friend slips and falls in your apartment, liability coverage can help cover their medical expenses.

Additional Living Expenses

In the event that your rental becomes uninhabitable due to a covered event like a fire, basic coverage often includes assistance with additional living expenses. This can help cover costs such as hotel stays, meals, and other necessities while your rental is being repaired.

Cost Comparison, Renter’s insurance options

Basic coverage for renter’s insurance is generally more affordable compared to more comprehensive options. While the cost can vary depending on factors like location, coverage limits, and deductible, opting for basic coverage can be a budget-friendly way to ensure you have some protection in place for your belongings and liability.

Additional Coverage Options

When it comes to renter’s insurance, basic coverage may not always be enough to protect your belongings and provide liability coverage. That’s where additional coverage options come in to give you extra protection and peace of mind.

Flood Insurance

Adding flood insurance to your renter’s policy is crucial, especially if you live in an area prone to flooding. Standard renter’s insurance typically does not cover damages caused by flooding, so having this additional coverage can save you from significant financial loss in case of a flood.

Earthquake Coverage

For those living in earthquake-prone regions, adding earthquake coverage to your policy is essential. Earthquake damage is usually not covered under standard renter’s insurance, so it’s important to consider this additional coverage for protection against earthquake-related damages to your belongings.

Impact on Cost

Adding these extra coverage options to your renter’s insurance policy will increase the overall cost of your premium. However, the added protection and peace of mind that these coverages offer are well worth the investment, especially if you live in an area prone to specific natural disasters.

Factors Influencing Premiums

When it comes to renter’s insurance premiums, there are several factors that can impact how much you pay for coverage. Let’s take a look at some of the key elements that influence the cost of your policy.

Location

The location of your rental property plays a significant role in determining your insurance premiums. Areas prone to natural disasters, high crime rates, or extreme weather conditions may result in higher premiums due to increased risk of damage or theft.

Coverage Limits

The amount of coverage you choose for your renter’s insurance policy will also affect your premiums. Opting for higher coverage limits means more protection for your belongings, but it also means a higher premium. It’s important to strike a balance between adequate coverage and affordability.

Deductible Amounts

The deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums since you are taking on more of the financial risk in case of a claim. However, make sure you can afford the deductible amount in case of an emergency.

Personal Property Value

The total value of your personal belongings will impact your insurance premiums. The more valuable items you have, the higher your premiums are likely to be. Take an inventory of your belongings and assess their value to ensure you have the right amount of coverage without overpaying.

Tips to Lower Premiums

– Shop around and compare quotes from different insurance companies to find the best rate.

– Consider bundling your renter’s insurance with other policies, such as auto insurance, for potential discounts.

– Install safety features in your rental unit, such as smoke alarms or deadbolts, to reduce the risk of damage or theft.

– Maintain a good credit score, as some insurance companies offer lower rates to individuals with better credit.

– Review your policy annually and make adjustments as needed to ensure you are getting the most value for your money.