Yo, diving into the insurance claims process, buckle up as we break it down from start to finish with some serious vibes.

From different types of claims to key stakeholders and the impact of technology, we got you covered.

Overview of Insurance Claims Process

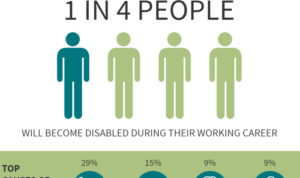

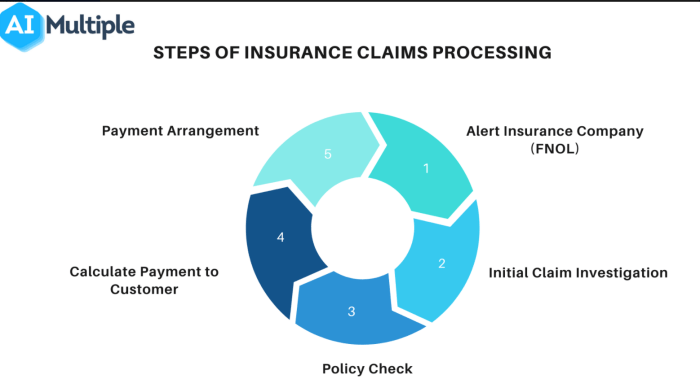

When it comes to the insurance claims process, it’s essential to understand the journey from start to finish. This process involves policyholders filing a claim with their insurance company to receive compensation for a covered loss or damage. Let’s break down the key steps involved in processing an insurance claim and why having a structured process is crucial for insurance companies.

Key Steps in Processing an Insurance Claim

- Notification: The policyholder must inform the insurance company about the incident or loss that occurred, providing all necessary details.

- Documentation: The insurance company will require documentation to support the claim, such as police reports, medical records, or repair estimates.

- Investigation: The insurance company will investigate the claim to determine the validity and extent of coverage based on the policy terms.

- Evaluation: After gathering all necessary information, the insurance company will evaluate the claim to determine the amount of compensation to be paid.

- Settlement: Once the claim is approved, the insurance company will settle with the policyholder by issuing a payment or arranging for repairs/replacements.

- Resolution: The insurance company will close the claim once the settlement has been made, ensuring all parties are satisfied with the outcome.

Importance of a Structured Claims Process

Having a structured claims process is vital for insurance companies to ensure efficiency, accuracy, and customer satisfaction. By following a defined set of steps, insurance companies can streamline the claims handling process, minimize errors, and provide timely assistance to policyholders in their time of need. A structured process also helps in managing costs, reducing fraud, and maintaining regulatory compliance, ultimately contributing to the overall success and reputation of the insurance company.

Types of Insurance Claims: Insurance Claims Process

Insurance claims can vary depending on the type of coverage you have. Here are some common types of insurance claims and examples of scenarios for each:

Auto Insurance Claims

- Auto insurance claims are filed for damages or injuries resulting from car accidents.

- Examples include fender benders, total loss due to a collision, or theft of the vehicle.

- Processing auto insurance claims involves assessing the damage, determining fault, and estimating repair costs.

Home Insurance Claims

- Home insurance claims are made for damages to your property or belongings within your home.

- Examples include fire damage, water leaks, or theft of personal items.

- Processing home insurance claims may require inspections, estimates for repairs, and documentation of losses.

Health Insurance Claims

- Health insurance claims cover medical expenses for treatments, procedures, or medications.

- Examples include doctor visits, hospital stays, surgeries, or prescription medications.

- Processing health insurance claims involves verifying coverage, submitting medical bills, and coordinating with healthcare providers.

Key Stakeholders in the Claims Process

In the insurance claims process, there are several key stakeholders who play vital roles in ensuring a smooth and efficient resolution. Effective communication between these stakeholders is crucial for a successful outcome.

Insured Party, Insurance claims process

The insured party is the individual or entity that has purchased an insurance policy to protect themselves against certain risks. Their role in the claims process involves reporting the incident or loss to the insurance company, providing relevant documentation, and cooperating with the adjuster to assess the damages.

Insurance Company

The insurance company is responsible for reviewing the claim, determining coverage, and ultimately paying out the claim if it is deemed valid. They assess the situation based on the terms of the policy and work with the insured party and adjuster to reach a fair resolution.

Adjuster

The adjuster is a representative of the insurance company who investigates the claim, assesses the damages, and determines the amount of compensation to be paid out. They play a crucial role in facilitating communication between the insured party and the insurance company, ensuring all parties are on the same page.

Importance of Effective Communication

Effective communication between all stakeholders is essential to ensure a timely and fair resolution of the insurance claim. Clear and open communication helps prevent misunderstandings, delays, and disputes, ultimately leading to a more satisfactory outcome for everyone involved.

Technology in Claims Processing

Technology has revolutionized the insurance claims process, making it more efficient and accurate than ever before. The use of AI, automation, and digital tools has streamlined claims processing, leading to faster claim resolutions and improved customer satisfaction.

AI in Claims Processing

AI plays a crucial role in claims processing by automating repetitive tasks, such as data entry and document verification. By using machine learning algorithms, AI can analyze vast amounts of data to detect patterns and anomalies, helping insurers detect fraudulent claims and make more accurate claim decisions.

Automation in Claims Handling

Automation has enabled insurers to process claims faster and more accurately. Claims systems can now automatically assign claims to the right adjusters, track the status of claims in real-time, and generate reports for analysis. This not only speeds up the claims process but also reduces human error and ensures consistency in decision-making.

Digital Tools for Claims Management

Digital tools like mobile apps and online claim portals have made it easier for policyholders to submit claims and track their status. Insurers can communicate with customers in real-time, provide updates on claim progress, and offer self-service options for faster resolutions. These tools enhance the overall claims experience and improve customer satisfaction.