When it comes to car insurance policies, understanding the various types, factors affecting premiums, coverage options, and making claims is crucial for every driver. Let’s dig into the details of this essential topic.

Types of Car Insurance Policies

Car insurance policies come in various types to cater to different needs and budgets. The main types include comprehensive, third-party, and third-party, fire, and theft insurance policies.

Comprehensive Insurance

Comprehensive insurance provides the most extensive coverage, including damages to your car, theft, vandalism, and liability to third parties. While it offers peace of mind, it tends to be the most expensive option.

Third-Party Insurance

Third-party insurance is the most basic and mandatory type of car insurance. It covers damages and injuries caused to others in an accident but does not cover your own vehicle. This is usually the cheapest option, suitable for older cars with low value.

Third-Party, Fire, and Theft Insurance

This type of insurance includes coverage for damages caused by fire or theft in addition to the basic third-party coverage. It strikes a balance between comprehensive and third-party insurance, offering a mid-range option in terms of coverage and cost.

In real-life scenarios, comprehensive insurance would be most suitable for new or expensive vehicles where the repair costs are high. Third-party insurance is ideal for budget-conscious drivers with older vehicles, while third-party, fire, and theft insurance can be a good choice for those who want a bit more coverage without the higher cost of comprehensive insurance.

Factors Affecting Car Insurance Premiums

When it comes to car insurance premiums, several factors come into play that can influence the cost of coverage. Understanding these factors can help individuals make informed decisions to potentially lower their insurance rates.

Age, driving history, type of vehicle, and location all play a significant role in determining insurance premiums. Younger drivers typically face higher premiums due to their lack of driving experience, while older drivers with a clean record may enjoy lower rates. The type of vehicle also matters, with luxury cars and sports cars often costing more to insure. Additionally, living in an area prone to accidents or theft can lead to higher insurance costs.

Impact of Age on Insurance Premiums

Age is a key factor in determining car insurance premiums. Younger drivers, especially teenagers, typically face higher rates due to their lack of driving experience and higher risk of accidents. As drivers get older and gain more experience, insurance premiums tend to decrease.

Role of Driving History in Insurance Costs

A clean driving record with no accidents or traffic violations can lead to lower insurance premiums. On the other hand, a history of accidents or tickets can result in higher rates as insurers see these drivers as higher risk.

Influence of Vehicle Type on Premiums, Car insurance policies

The type of vehicle you drive can impact your insurance costs. Luxury cars, sports cars, and vehicles with high repair costs often come with higher premiums. On the other hand, more affordable and safe vehicles may result in lower insurance rates.

Effect of Location on Insurance Rates

Your location plays a significant role in determining insurance rates. Urban areas with higher rates of accidents, theft, and vandalism typically have higher premiums compared to rural areas. It’s essential to consider your location when shopping for car insurance.

Tips to Lower Insurance Premiums

– Maintain a clean driving record.

– Consider bundling multiple insurance policies with the same provider.

– Opt for a higher deductible to lower your premium, but be prepared to pay more out of pocket in case of a claim.

– Shop around and compare quotes from different insurance companies to find the best rate.

Understanding Deductibles and Coverage Limits

Deductibles and coverage limits play a crucial role in determining insurance costs. A higher deductible typically results in lower premiums, but it also means you’ll have to pay more out of pocket in the event of a claim. Coverage limits define the maximum amount your insurer will pay for a covered claim. Understanding these terms can help you choose the right coverage for your needs while keeping your premiums affordable.

Understanding Coverage Options

When it comes to car insurance policies, understanding the different coverage options available is crucial to ensuring you have the right protection in place. Let’s break down the key coverage options and when they come into play.

Liability Coverage

Liability coverage is a fundamental part of any car insurance policy. It helps cover the costs of bodily injury and property damage that you are legally responsible for in an accident. This coverage is required by law in most states, and it provides financial protection if you injure someone else or damage their property while driving.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object. This coverage is especially beneficial if you have a newer car or a vehicle with a higher value, as it can help protect your investment in case of an accident.

Comprehensive Coverage

Comprehensive coverage goes beyond collisions and covers damage to your vehicle from non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. Having comprehensive coverage can provide peace of mind knowing that you are protected from a wide range of potential risks.

Additional Coverage Options

While liability, collision, and comprehensive coverage are the core components of a car insurance policy, there are additional coverage options that can provide extra protection. For example, adding uninsured/underinsured motorist coverage can help cover your expenses if you are in an accident with a driver who doesn’t have insurance or enough coverage to pay for your damages.

Importance of Uninsured/Underinsured Motorist Coverage

Having uninsured/underinsured motorist coverage is crucial in protecting yourself in case you are involved in an accident with a driver who lacks insurance or sufficient coverage. This additional coverage can help cover your medical bills, lost wages, and other expenses that the at-fault driver’s insurance may not fully compensate for.

Making Claims and Utilizing Car Insurance

When it comes to making a car insurance claim after an accident, it’s important to follow the necessary steps to ensure a smooth process. Proper documentation and timely reporting are key factors in getting your claim processed efficiently.

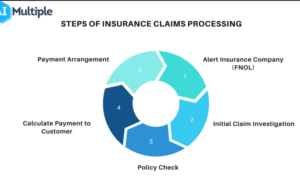

Steps for Making a Car Insurance Claim:

- Contact your insurance company as soon as possible after the accident.

- Provide all relevant information, including details of the incident, photos, and contact information of any parties involved.

- Follow the instructions given by your insurance company on how to proceed with the claim.

- Cooperate with the insurance adjuster assigned to your case and provide any additional information or documentation requested.

Tips for Documenting and Reporting Incidents:

- Take photos of the accident scene, including damage to vehicles and any injuries sustained.

- Collect contact information from witnesses, if possible.

- File a police report and obtain a copy for your records.

- Keep all receipts and documentation related to the accident, such as repair estimates and medical bills.

Role of Insurance Adjusters and Claims Evaluation:

Insurance adjusters are responsible for evaluating claims and determining the amount of compensation to be paid out. They will review all the information provided, assess the damage, and negotiate settlements with the parties involved.

Common Pitfalls to Avoid:

- Not reporting the incident promptly to your insurance company.

- Exaggerating or providing false information about the accident.

- Not following the instructions provided by your insurance company.

- Settling for a low compensation amount without exploring all your options.