Kicking off with disability insurance claims, this topic delves into the different types of claims, the filing process, common reasons for denials, legal rights, and the impact on individuals and families. Get ready to explore the ins and outs of disability insurance claims!

Types of Disability Insurance Claims

When it comes to disability insurance claims, there are different types to consider based on the length of the disability and the specific circumstances. Here are the main types you should know about:

Short-Term Disability

Short-term disability insurance provides coverage for a limited period, usually up to six months. This type of claim is typically used for temporary disabilities that prevent you from working for a short period, such as recovering from surgery or an illness.

Long-Term Disability

Long-term disability insurance kicks in after the short-term coverage ends and provides benefits for a longer duration, sometimes until retirement age. This type of claim is suitable for more severe and long-lasting disabilities that prevent you from working for an extended period, such as a chronic illness or permanent injury.

Social Security Disability Insurance (SSDI)

SSDI is a federal program that provides benefits to individuals who are unable to work due to a disability. To qualify for SSDI, you must meet specific criteria set by the Social Security Administration, including having a severe medical condition that is expected to last at least a year or result in death.

Each type of disability insurance claim has its own eligibility criteria and requirements, so it’s essential to understand what is needed to file a successful claim and receive the benefits you deserve.

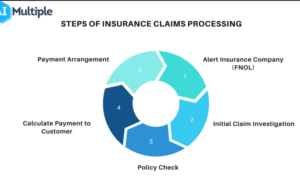

Process of Filing a Disability Insurance Claim

When it comes to filing a disability insurance claim, there are several steps involved to ensure a smooth and successful process. It is crucial to have all the necessary documentation ready and understand how the claim will be reviewed and evaluated by the insurance provider.

Step-by-Step Process

- Gather all relevant medical records and documentation that support your disability claim.

- Fill out the necessary forms provided by your insurance provider accurately and completely.

- Submit all required paperwork, including medical records, to the insurance company in a timely manner.

- Wait for the insurance company to review your claim and make a decision on whether to approve or deny it.

- If your claim is approved, you will start receiving benefits according to the terms of your policy.

Documentation Required

- Medical records detailing your diagnosis, treatment plan, and prognosis.

- A completed claim form provided by the insurance company.

- Any additional documentation requested by the insurance provider to support your claim.

Review and Evaluation Process

- Once your claim is submitted, the insurance provider will review all the documentation provided.

- They may request additional information or have you undergo an independent medical examination to assess your condition.

- The insurance company will evaluate your claim based on the terms of your policy and determine if you meet the criteria for disability benefits.

- You will be notified of the decision, and if approved, you will begin receiving benefits accordingly.

Common Reasons for Disability Insurance Claim Denials

When it comes to disability insurance claims, there are several common reasons why claims may be denied. Understanding these reasons can help individuals navigate the process more effectively and increase their chances of a successful claim.

Insufficient Medical Evidence

- One of the main reasons for denial is lack of sufficient medical evidence to support the disability claim.

- Insurance companies often require detailed documentation from healthcare providers to prove the severity and impact of the disability.

- It is crucial to gather all medical records, test results, and doctor’s assessments to strengthen your case.

Failure to Meet Definition of Disability

- Claims can also be denied if the disability does not meet the specific definition Artikeld in the insurance policy.

- Understanding the criteria for disability Artikeld in your policy is essential to avoid this common pitfall.

- Consulting with a legal expert or insurance professional can help clarify any ambiguous terms in the policy.

Missed Deadlines or Paperwork Errors

- Another reason for denial is missing deadlines or making errors in the paperwork submission process.

- Be sure to carefully review all requirements and timelines for submitting documents to avoid unnecessary delays or denials.

- Keeping detailed records of all communication and submissions can also help in case of disputes.

Appeals Process for Denied Claims

- If your claim is denied, you have the right to appeal the decision.

- The appeals process typically involves submitting additional evidence or documentation to support your case.

- Working with a legal advocate or disability insurance specialist can help navigate the appeals process more effectively.

Tips to Prevent Denials

- Seek professional guidance when filing a disability insurance claim to ensure all requirements are met.

- Keep thorough records of medical appointments, treatments, and symptoms to substantiate your claim.

- Review your policy carefully to understand the definition of disability and other key terms to avoid misunderstandings.

Legal Rights and Resources for Disability Insurance Claimants: Disability Insurance Claims

In the process of filing disability insurance claims, it is crucial for individuals to be aware of their legal rights and the resources available to assist them in navigating the complex system. Legal rights provide protection and ensure fair treatment for claimants, while legal resources such as attorneys or advocates can offer valuable support and guidance throughout the claims process.

Legal Rights of Individuals Filing Disability Insurance Claims

- Individuals have the right to file a disability insurance claim if they are unable to work due to a qualifying medical condition.

- Claimants have the right to appeal a denial of their disability insurance claim and request a review of the decision.

- Claimants are entitled to receive timely and accurate information about the status of their claim and the reasons for any denials.

Role of Legal Resources in Assisting Claimants

- Attorneys or advocates can help claimants understand their legal rights and options for pursuing a disability insurance claim.

- Legal professionals can assist claimants in gathering necessary documentation, completing paperwork, and preparing for appeals hearings.

- Legal resources can provide representation and advocacy on behalf of claimants to ensure their rights are protected throughout the claims process.

Importance of Understanding Rights and Seeking Legal Assistance

- Understanding one’s legal rights is essential for ensuring fair treatment and a successful outcome in the disability insurance claims process.

- Seeking appropriate legal assistance can help claimants navigate the complexities of the legal system and increase their chances of a favorable decision on their claim.

- Legal resources can provide invaluable support and guidance to claimants, helping them secure the benefits they are entitled to under their disability insurance policy.

Impact of Disability Insurance Claims on Individuals and Families

Successfully obtaining disability insurance benefits can have a profound impact on both individuals and their families. It provides much-needed financial support, emotional relief, and social stability during challenging times.

Financial Stability, Disability insurance claims

Receiving disability insurance benefits can help individuals and families cover essential living expenses, medical bills, and other financial obligations. This support ensures that they can maintain their standard of living despite a loss of income due to disability.

Emotional Well-being

Knowing that there is financial assistance available through disability insurance can alleviate stress and anxiety for individuals and their families. It allows them to focus on recovery and well-being without the added burden of financial insecurity.

Social Support

Disability insurance benefits can also help individuals stay connected to their communities and support networks. By providing a safety net, these benefits enable individuals to continue participating in social activities, maintaining relationships, and preventing isolation.